This online EMI Calculator – Equated Monthly Installments (EMI) Calculator easily estimates your monthly payments accurately and plan your finances effectively. This tool is also known as: loan EMI calculator, home loan EMI calculator, car loan EMI calculator, personal loan EMI calculator, calculate EMI, equated monthly installment etc.

EMI Calculator

How to Use the EMI Calculator:

- Principal Loan Amount (₹): Enter the original amount of the loan you plan to borrow.

- Loan Term (Years): Enter the duration of the loan in years.

- Interest Rate (%): Enter the annual interest rate offered on the loan.

- Click Calculate: Click the “Calculate” button to instantly see the result:

- EMI (₹): EMI is your estimated monthly payment amount.

- Total Amount Payable (₹): This is the total amount you will repay over the loan term, including both principal and interest.

- Interest Amount (₹): This is the total amount of interest calculated over the loan term.

Disclaimer:

- Accuracy: This calculator provides estimates based on the information you input. Actual loan terms and interest rates may vary depending on the lender and your creditworthiness.

- Loan Products: Loan products and interest rates are subject to change. Always consult with a financial institution for the most up-to-date information.

- This EMI calculator is for informational purposes only and should not be considered as financial advice.

EMI Calculator – Plan Your Loan Repayments Smartly

Loan repayments are made through Equated Monthly Installments (EMIs). Knowing your EMI in advance is essential to manage both current expenses and long-term financial goals. An online EMI calculator helps you estimate your monthly repayment accurately before taking a loan.

Factors That Affect Your EMI

Your EMI depends on three key factors:

- Loan Amount: Higher loan amounts result in higher EMIs.

- Interest Rate: A lower interest rate reduces your overall repayment burden.

- Loan Tenure: Longer tenures lower EMIs but increase total interest paid, while shorter tenures increase EMIs but reduce interest cost.

Choosing the right balance between these factors is crucial for comfortable repayment.

How an EMI Calculator Helps

With credit usage rising rapidly, it’s more important than ever to understand your repayment capacity. An EMI calculator:

- Gives an accurate estimate of your monthly EMI

- Helps keep your debt-to-income ratio below 50%, improving loan approval chances

- Saves time by eliminating manual calculations

- Avoids errors and provides instant results

- Offers loan-specific calculations for home, car, personal, and education loans

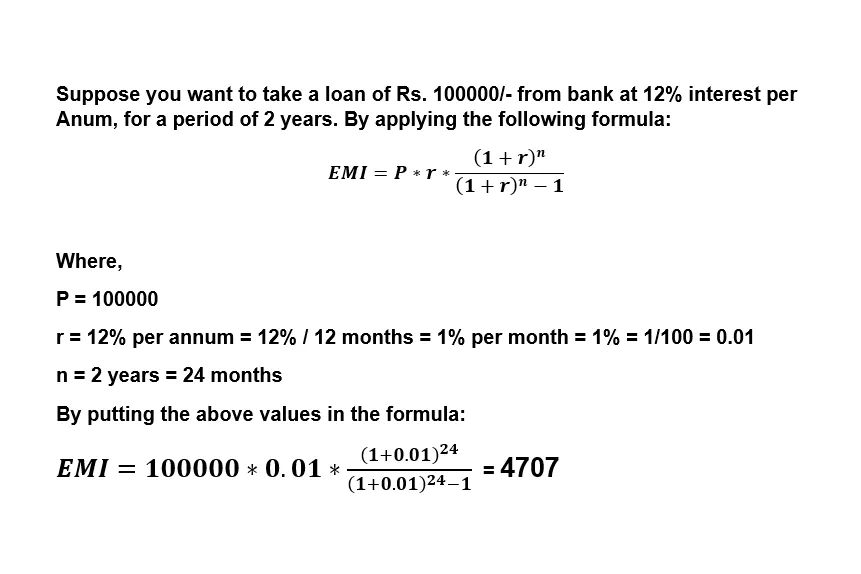

EMI Calculation Formula

Most EMI calculators use this standard formula:

EMI = [P × R × (1 + R)ᴺ] / [(1 + R)ᴺ − 1]

Where:

- P = Loan principal

- R = Monthly interest rate

- N = Loan tenure (in months)

Types of EMI Calculators

Home Loan EMI Calculator

Ideal for long-term, high-value loans. Enter loan amount, tenure, and interest rate to instantly estimate your EMI.

Car Loan EMI Calculator

Helps you calculate affordable EMIs and avoid repayment stress or asset repossession.

Personal Loan EMI Calculator

Useful for short-term, high-interest loans taken for emergencies, travel, weddings, or renovations.

Education Loan EMI Calculator

Estimates EMIs after the moratorium period for domestic or overseas education loans.

Loan Against Property EMI Calculator

Calculates EMIs for secured loans taken by mortgaging residential or commercial property.

Advantages of Using an EMI Calculator

- Free and accessible anytime

- Instant and highly accurate results

- Simple, fast, and user-friendly

- Helps plan loans without financial strain

Conclusion

An EMI calculator is a powerful planning tool that helps you borrow responsibly. By understanding your EMI in advance, you can choose the right loan and stay financially confident throughout the repayment journey.

FAQ (Frequently Asked Questions):

- Q: How is EMI calculated?

- A: EMI is calculated using a formula that takes into account the principal amount, interest rate, and loan term.

The formula to calculate EMI along with example is as follows:

- Q: What is the difference between principal and interest?

- A: The principal is the original amount of the loan, while the interest is the cost of borrowing that money.

- Q: Can I change the loan term or interest rate after taking out a loan?

- A: In some cases, it might be possible to renegotiate loan terms, but this depends on the lender’s policies.